Tariffs, Oil, and The Boss: Unpacking the Impact of New Legislation and Market Shifts

US Senator Lindsey Graham has proposed new legislation to impose tariffs on nations buying crude oil or petroleum products from Iran. Due to growing demand, Iran is now looking to increase its output by 20% increase over its existing production. So the way this would work would be that any country buying Iranian oil would then be penalized and would have to pay a tariff for any other goods that it delivers into the United States. Iranian crude traded at a discount of $10 – $15 per barrel compared to Brent last year, so even a stiff tariff might not be enough to stifle trade in a meaningful way. While there presently are sanctions on Iranian oil, the loopholes (eg switching off transponders, ship-to-ship transfers, etc) utilized to evade these sanctions have kept the oil flowing. When the USA imposes tariffs on other countries, there should be no confusion as to who ends up shouldering the burden of these tariffs. When a government places a tariff on a product, it increases the cost of that product. The US consumer ends up paying this tariff. It’s a tax on Americans. Be advised that anyone saying something to the contrary, over and over, does not make it true. Let’s say the U.S. imposes a tariff on imported cars. The car importer now has to pay more for each car they bring into the country. To offset this extra cost, the importer increases the price of the cars they sell to dealerships. Dealership, in turn, raise the price of the cars for consumers. Ultimately, the consumer ends up paying more for the car. In essence, tariffs act as a hidden tax, increasing the cost of living for consumers. While they can protect domestic industries in the short term, they often lead to higher prices, reduced consumer choice, and potential retaliation from other countries. We all learned this in our American History class in High School: Smoot Hawley. Not to be outdone, California Governor Gavin Newsom proposed a plan last week which would mandate that oil refiners maintain minimum reserves of gasoline to take the edge off of any supply disruptions and potential price spikes. Has anyone tried to find – or build – a storage tank in California recently? Meddle meddle…oy vey. Brent crude futures ended last week at $79.68 per barrel, with WTI finishing at $76.65.

The stock market seems to have shaken off its recent body blows, now resembling Bald Bull more than Glass Joe. The S&P 500 index on Friday nailed its best weekly advance since late October last year with a 4% gain. Consumer health still looks robust and once again talk of a soft landing is getting louder. Starbucks got a new CEO, poaching Chipotle’s head honcho – but as long as the guy in front of you is ordering a Iced Chocolate Almondmilk Shaken Espresso with Five shots and Two pumps of chai, you still have to wait longer than you want to in order to get your coffee.

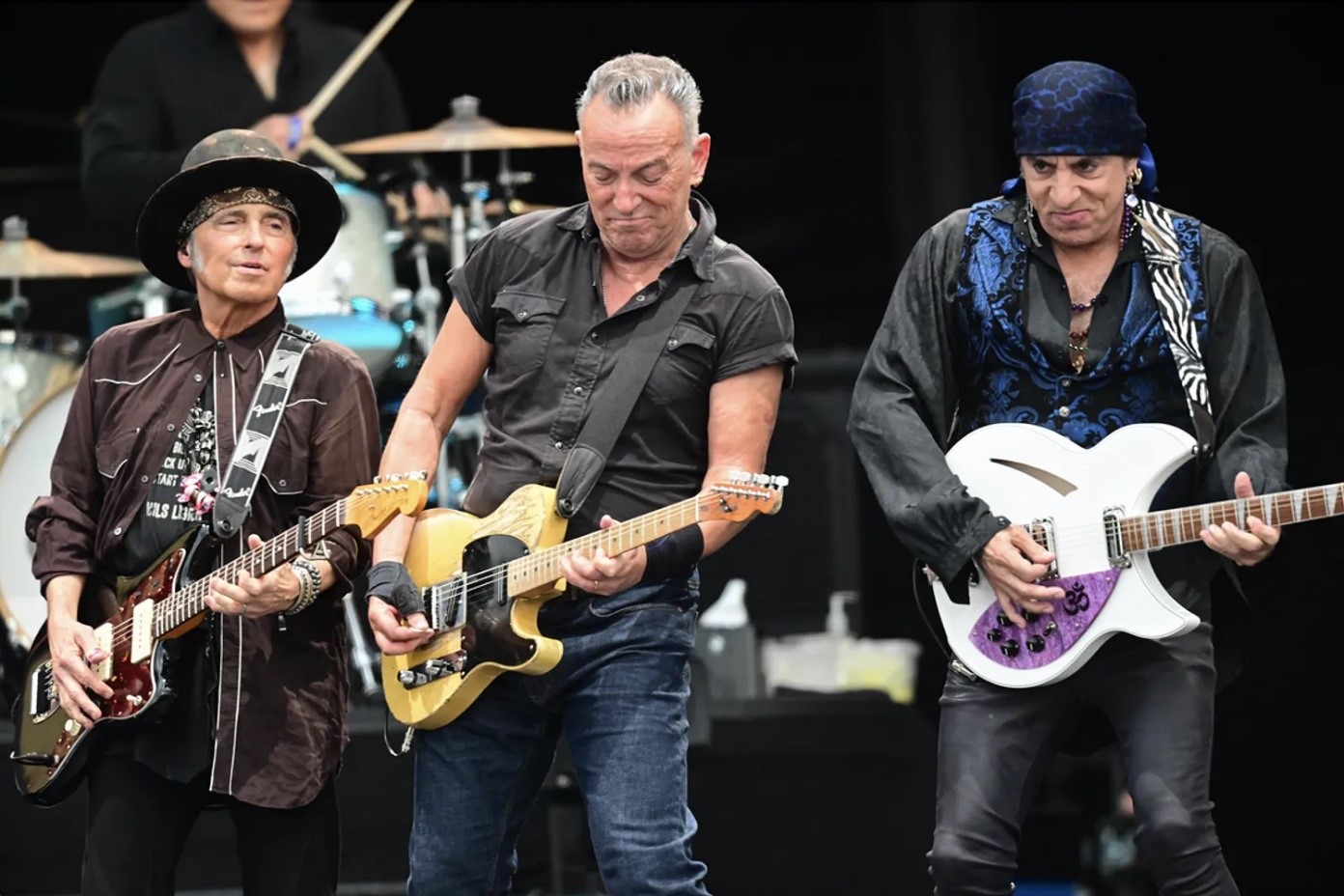

Tomorrow, Bruce Springsteen and the E Street Band will take the stage at Citizens Bank Park in Philadelphia. The City of Brotherly Love has a strong affection for The Boss and he always reciprocates with a great show for his dedicated fans. Of course, The Tank Tiger will be in attendance as this is a mandatory job requirement. Collectively, The Tank Tiger employees have been to over 200 of his shows over the past 50 years. Springsteen creates a powerful connection with his audience and his down-to-earth persona has endeared him to fans. His music explores timeless themes of love, loss, hope, and the American Dream, making his songs relevant across generations. Have you ever been to a show?