|

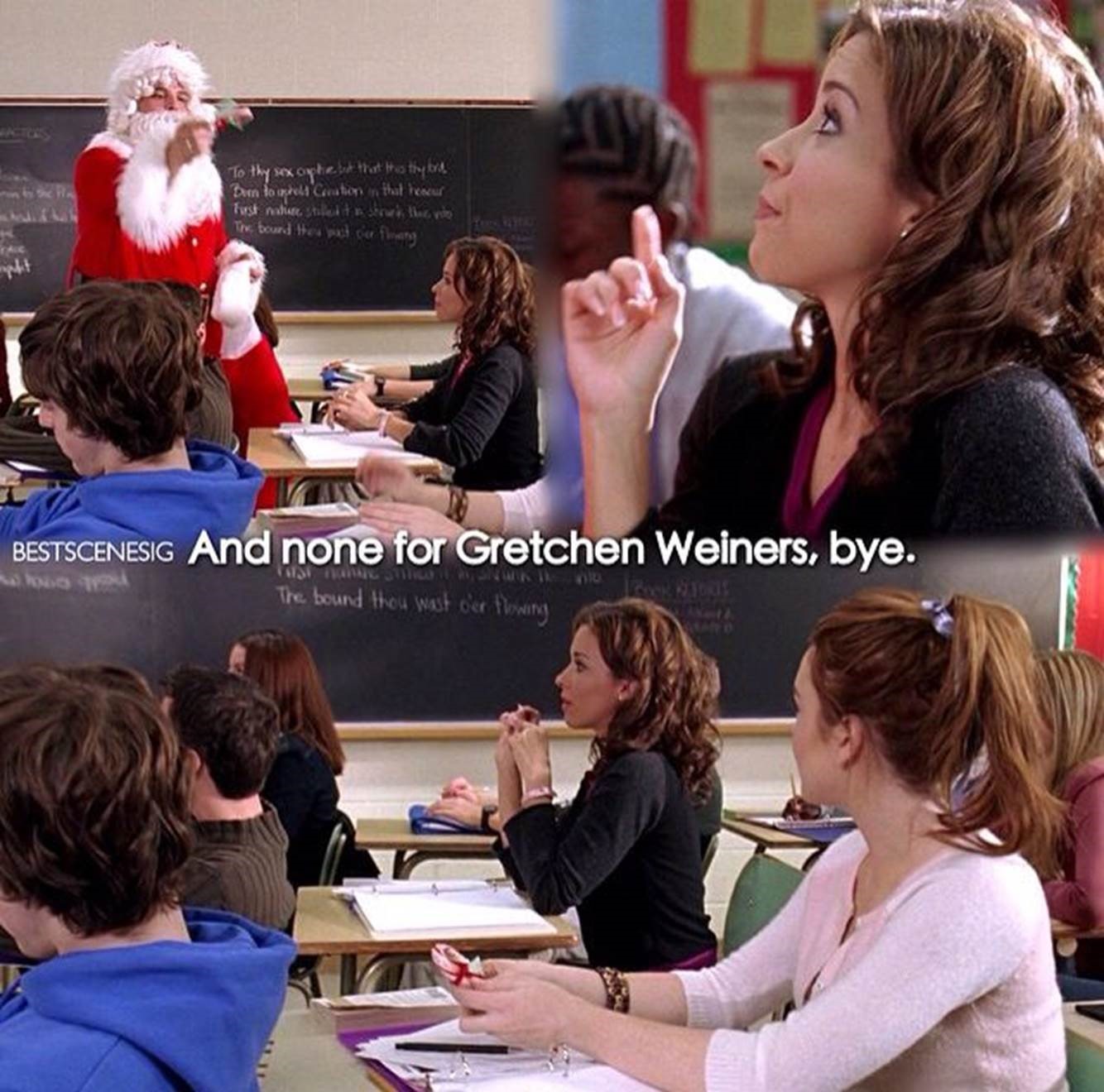

It’s time to assign tariffs! Or is just another episode of Mean Girls? There’s 4 for you, 2 for you, one for you and none for Gretchen Weiners. Bye. On March 4, 25% tariffs were levied against Mexico, Canada and China. Of course, China promptly retaliated with tariffs on some agricultural imports. The stock market took a beating and then the US Secretary of Commerce said some of the tariffs could be rolled back as soon as the next day. Over the next 2 days announcements were made that tariffs related to autos were delayed until April 2. A subsequent announcement proclaimed that there would be delays on tariffs on Mexican and Canadian goods until April 2. Is it a coincidence that the delay is one day after April 1? April Fools maybe?? Having said that, many tariffs on lots of goods still remain, and the looming uncertainly of April 2 has companies and consumers walking on egg$. Maybe we shouldn’t walk on egg$ either, since they are so egg$pensive. Speaking of egg$…the eggheads will be in H-Town this week…it’s CERAweek! We all remember how The Tank Tiger rocked the house last year at CERAweek, with its groundbreaking presentation that showcased our peer to peer platform to rave reviews. Haven’t signed up yet? What are you waiting for?

Not wanting to be left out of the misdirection party, Russia’s deputy prime minister burped that OPEC+ could rescind its plan to increase crude production. The cartel had indicated that they would commence pumping more in April, but the word out of Russia is that they could “always play in the other direction” if the market started to get soft. Four out of five doctors know that nothing puts more pressure on prices like increased supply. For the week, crude prices dropped by nearly 5%, the largest weekly decline since last October. Morgan Stanley is projecting that Brent crude prices will fall below $70 for the second half of this year.

But there is even more headline news on the energy front: US investment kingpin BlackRock agreed to buy two major ports on the Panama Canal from Hong Kong-based CK Hutchison for $22.8 billion. Trying to make sure the spotlight doesn’t shy away from him, Paul Singer and Elliott Investment Management upped its activist investor positions in both BP and Phillips 66 – with nasty letters to both companies to be scripted soon for sure. Meanwhile, Chris Wright, the US energy secretary, wants $20 billion to fill ‘er up and top off the Strategic Petroleum Reserve. But what is the really really big news? The Tank Tiger 10 year anniversary party in Houston is NEXT WEEK! You go Glen Coco!

|