Boom Boom Boom Goes the Contango Drumbeat

An old man sips on his sweet tea as he casts a curious eye towards the little boy digging feverishly through a huge pile of manure, moving a shovel full at a time from one pile and slowly building another. After a while, curiosity got the best of him and he asked the boy why he was shoveling with so much effort. The unexpected response: “There has to be a pony in here somewhere!”. The story always has a moral. We all know that staying optimistic is a preferred modus operandi. “Show a little faith, there’s magic in the night.” But sometimes blind faith will get someone no further than where they first started. For those of us looking for lower energy prices, the tumultuous markets of last week certainly was faith rewarded. Oil prices ended the week at their lowest levels in nearly four years. It’s a funny coincidence, but OPEC+ divulged a plan to increase supply amidst concerns that the tariffs will nudge the global economy into recession. On Thursday, the cartel announced that it would triple a planned output increase for May. The pre-existing floor to oil prices – namely a low risk of recession and the OPEC+ artificial production restrictions have now left town on a high horse. WTI futures ended the week near $61 a barrel on Friday – down about 11% for the week. If this is a market share grab, we could easily see the way down to $40 oil. Cue up the contango drumbeat…boom boom boom. The Tank Tiger has tanks to show.

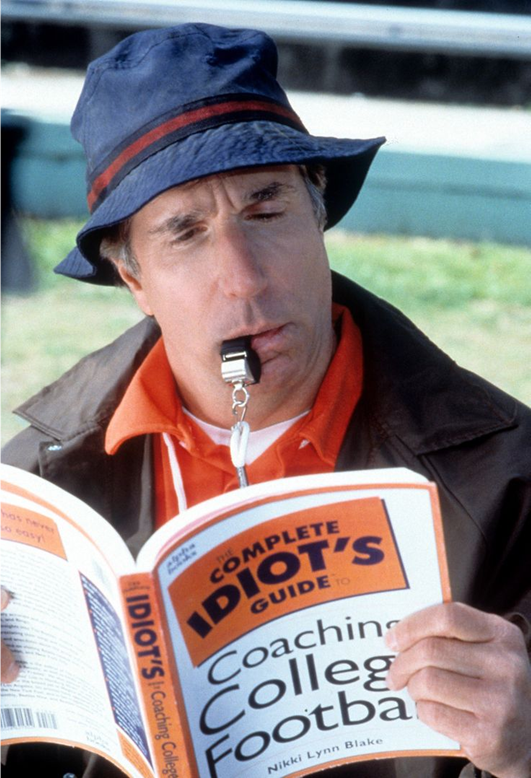

Now the bad news. The stock market. The bull market is on its back, wriggling it’s legs to and fro not unlike a cockroach turned upside down. The S&P 500 dropped 9% on the week, its worst week since the breakout of Covid in early 2020. It’s going to be a rocky road ahead and while there will certainly be optimistic news providing short term upticks, the long run bull market is dead until some clarity reappears. We could wish for better news, but like my great college offensive line coach George Azar once said after we messed up a blocking assignment, “If you wish in one hand and crap in the other, guess which one fills up first.”

While it’s evident that the tariff announcements have proven disruptive, the over arching goal of the tariffs has not been made clear and the goal looks more nebulous than anything else. Perhaps it is push the button and see what happens, then respond. It might work. Eggheads from all different walks have weighed in on what they believe are the chess playing objectives, but the weird thing is that they all seem to have different opinions on what it actually is. Are we playing chess, or is it roll the dice and Chutes and Ladders? What is clear is that uncertainty has taken the helm and this uncertainty creates a deer in the headlight response from capital investors and consumers. The response? Doing nothing and buying nothing seems to be a the safest play, since you can’t get fired or go broke by doing nothing – but unfortunately that takes you closer to a real recession. While the once efficient supply chains get dismembered, there will be a need for some slack in the line to provide adequate timing to go to the back of the playbook and create optionality. Storage tanks are a great way to inject that slack. Talk to us. We’re not quite as creative as Coack Klein, but sometimes calling an audible and taking the road less traveled can be a green shoot to a new optimization.