Activist Investors and OPEC+ Drama: Navigating the Turbulent Waters of Corporate Disruption and Oil Market Tumble

Once again, an activist investor (in other words: a bully with a bag of money), has appeared on the scene to disrupt the enterprise of a long standing integrated refining and marketing company. Last week, Elliott Investment Management unveiled a $1 billion stake in Phillips 66 and chirped about the company’s supposed underperformance. Their all too familiar strategy is to create immediate shareholder value by ripping up the tracks of a company’s long term planning, investment and strategy. The activist investor cares little about the company’s employees, stakeholders or the communities that these rooted companies operate within. Much like pulling off the fruit before it’s ripe or killing the goose for the golden egg, these activists prey on the allure of the short term win vs. the long term rewards. I guess their parents never read to them the story about the tortoise and the hare. The activist doesn’t make or produce anything. They often have nothing to do with the industry that they pillage. They don’t understand or care about the intricacies of a safe and efficient manufacturing process. Their game is simple: They buy stocks they view as undervalued and pressure management to do things they believe will raise the value, such as giving more cash back to shareholders, eliminating research and development, or shedding divisions that they think are driving down the stock price. They then find a few puppets and demand board seats, replace CEOs, and cook up specific business strategies with overweighted attention to financial metrics that reward the short run at the expense of the long run. This opinion is supported by the fact that 40 percent of activist investors either reduce or sell out their positions in less than 6 months after making their investment. There is no reason for a long term investor to accept the actions of an activist since it’s likely they have very different investment horizons. Go away bullies.

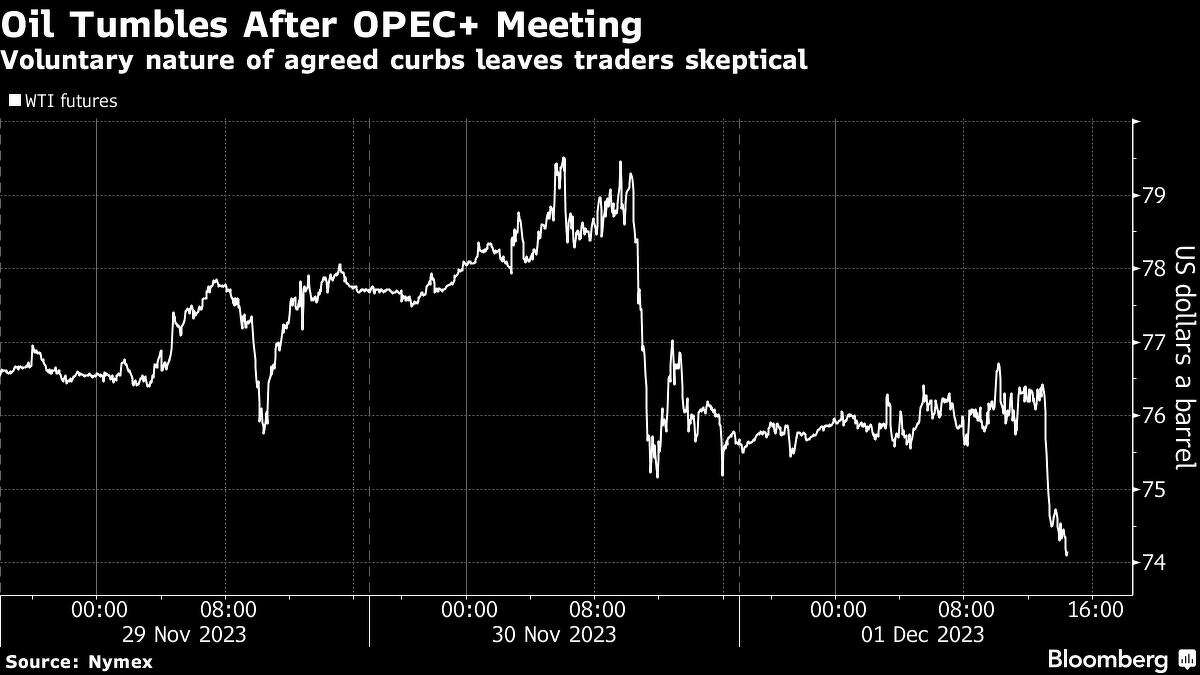

Citing all kinds of reasons other than the fact that the price of oil just wants to go down, the leaders of OPEC+ tried to convince their members to voluntarily adhere to existing cuts and to actually further curtail production. They ended up looking like Georgia and Ohio State trying to woo the committee to let them into the playoffs. Traders likened this to shares of the Brooklyn Bridge being sold, and oil prices dropped for a sixth consecutive week. WTI ended the week at $74.07. The Brent Spread is close to $5 / barrel, indicating US production growth is real and spectacular. Meanwhile, the strong November rally in the stock market has been fueled by easing inflation, declining long-term U.S. Treasury yields and expectations for rate cuts (yay!) next year. Santa Rally! Ho ho ho!