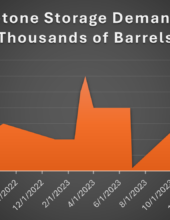

Warm Trends, Cool Markets: A Week in Review – Distillate Contango in NY Harbor

Climate change. No matter what your scientific, political ,economic or superstitious position is on this topic, there’s no question that things are getting warmer. Now if you want to debate the cause and effect, that’s an equine of a variable hue. We might never really know what’s causing it to get warmer..… Well, my temperature’s rising, and my […]

Read more