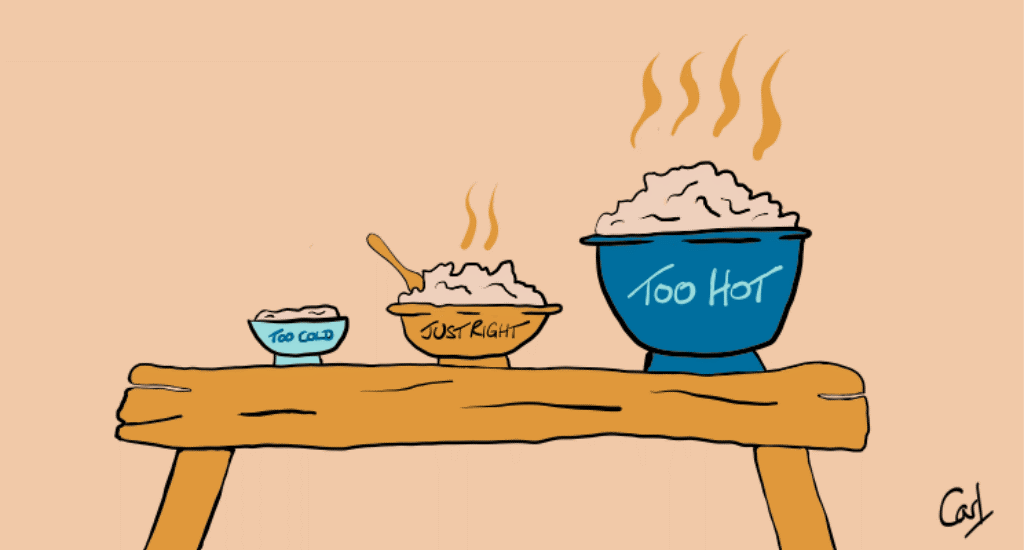

Goldilocks Economy: Market Cheers Amid Lower Inflation and Jobless Claims, But Oil Prices Remain a Wild Card

Last week saw headline prices declining during the month for the first time in four years. Along with it, annual inflation fell below 3% for the first time in a year. Core inflation was better than forecast, coming in at 3.3% which was the lowest in three years. Supporting this positive economic news was the fact that there was a significant decline in weekly jobless claims. So we could be witnessing a confluence of lowering inflation amidst low unemployment. Truly a Goldilocks scenario. The stock market applauded. And Fed Chairman Powell winked and nodded about interest rate cuts coming. The S&P 500 secured a two-week win streak on Friday, tacking on gains in 10 out of the last12 weeks. The yield on the 10-year Treasury dropped to 4.19% from 4.29%. We all await the next set of numbers, which could either act as confirmation, or once again conjure up the all too familiar ball of confusion.

As fuel prices go up, confidence in the economy goes down. Of course, 50% of the price at the pump is the cost of crude oil, the price of which is set globally. It seems easy to point fingers at big oil or politicians when prices are increasing, but the reality is there are 9,000 independent petroleum companies which produce around 83% of this country’s oil. In 2023, US oil production hit new highs, averaging 12.9 million barrels per day and 2024 looks to be locking in a 2% increase over those levels. It’s been almost two years, but despite all of the volatile global headlines, crude oil has been paying rent in the range of $75-$90 a barrel over that period – kind of like wearing that same pair of sweatpants you have had since college. We have artificial stimuli of OPEC+ production cuts sustaining the floor price. History tells us that cartels are like Hollywood marriages…they cheat, fight and the relationship falls apart. These actions are juxtaposed against the knowledge of untapped spare capacity, stealthy increases of US production, an eventual end to global conflicts and the green machine keeping a ceiling on prices. Without proof of demand growth domestically and in China, it’s really difficult to paint a prevailing and everlasting bullish picture for oil prices. So voila…a tight trading range. N’est pas? Brent finished the week at at $85.08 a barrel and WTI settled at $82.10.

Fortunately, refineries and offshore production facilities did not suffer severe damage from Hurricane Beryl, although your fellow Houstonians who are still waiting for power to be restored may not be as chipper. There was also positive talk last week about a Middle East cease fire. As the world turns, The Tank Tiger continues to prospect for available storage for all of our customers. Last week we went digging for storage for the following commodities: Propylene, Monomers, Gasoline, Bio Feedstock, Ethanol, Jet Fuel, Acetone and Distillate. This isn’t just a petroleum party, we’re doing more and more in the chemical arena and we’re always interested in learning about any spare capacity from our friends in the midstream space. Keeping your tanks full is what makes us happy. Turn the Tiger loose on your tank business!