|

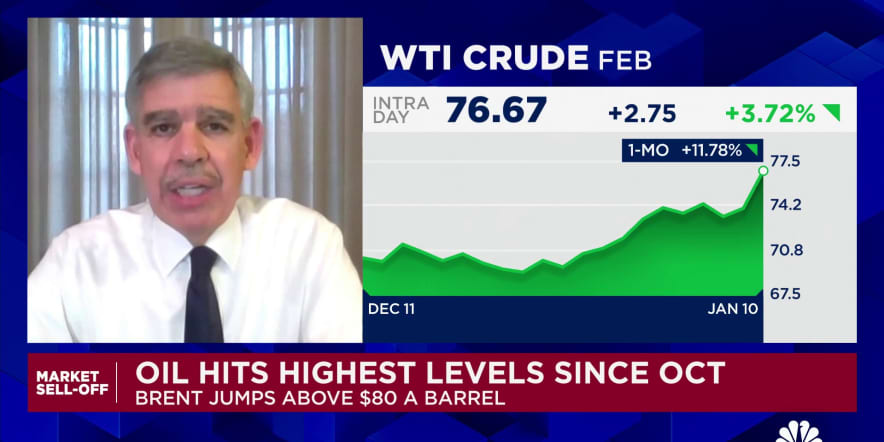

Just when we all thought that our friend the contango was putting on its Captain Comeback cape, the proverbial rug was pulled out from under it last week. Oil prices continue to rise, fostered by increased demand for heating fuels due to colder-than-normal weather in the Northern Hemisphere. Oil prices rose to their highest levels in three months, with Brent crude futures settling at $79.76 a barrel and WTI futures settling at $76.57 on Friday. Diesel prices are at their highest level since July. Temperatures across Europe and the US have been cold cold cold and are expected to persist for now. As a result, increased demand has enabled backwardation to root itself as Cushing inventories are now at 10 year lows.

Geopolitical events are also supporting the price rally. Ukraine and Russia have not tapered their hostilities, with oil infrastructure being put in harm’s way. The US has decided to clamp down further with new sanctions on Russia’s energy sector, focused on major oil companies and shipping vessels. Iran continues its saber rattling and threats towards Israel as the incoming administration has not made it a secret that future US policies may tighten sanctions on Iran’s oil exports as well.

This week delivers the first full trading week of the year with inflation numbers in the spotlight. Today and tomorrow will unveil the PPI and CPI reports, respectively. Friday’s robust jobs report spurred the Bank of America to predict that rate cuts are muerto and that there actually might be an interest rate HIKE this year. The labor market continues to be incredibly resilient. We need all of the workers we can get. A second inflation round that forces the Fed to actually raise rates and increase Treasury yields could make 2025 a substandard year for the stock market.

Meanwhile, our friends at P66 stepped up with a wowsa announcement. They have entered into a definitive agreement to acquire EPIC Y-Grade GP, LLC and EPIC Y-Grade, LP, collectively known as EPIC NGL, for $2.2 billion in cash. The acquisition includes long-haul natural gas liquids pipelines, fractionation facilities, and distribution systems. It’s nice to see when well established companies continue to see value in midstream assets. They may not be sexy, but boy are they important.

AFPM is super early this year, with festivities kicking off on the Riverwalk during the weekend of March 1st and it will be here before you know it. The Tank Tiger plans to be there in full force, so if you want to tee up a 30 minute meeting with us, we’d be happy to put you on our dance card. Just let us know anytime.

|