Oil Market Twists: Backwardation, Geopolitics, and a Big Midstream Move

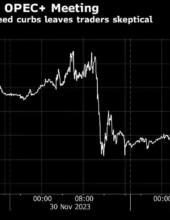

Just when we all thought that our friend the contango was putting on its Captain Comeback cape, the proverbial rug was pulled out from under it last week. Oil prices continue to rise, fostered by increased demand for heating fuels due to colder-than-normal weather in the Northern Hemisphere. Oil prices rose to their highest levels […]